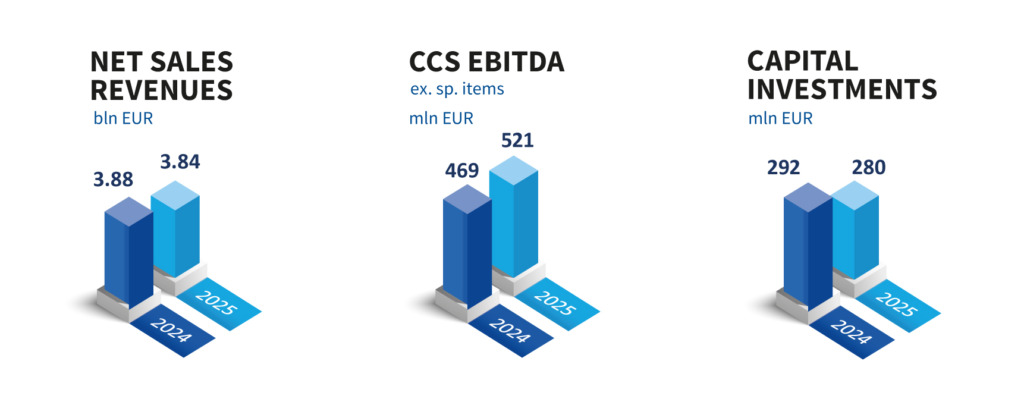

- Net sales revenues: EUR 3.84 billion

- CCS EBITDA: EUR 521 million (+11%)

- Capital investments: EUR 280 million

- Modernization of Rijeka Refinery: 99% of completion, testing in progress

Zagreb, 19 February 2026 – 2025 was very successful for all business segments of INA Group. Clean CCS EBITDA amounted to EUR 521 million, which is 11% above the previous year.

Refining and Marketing incl. Consumer Services and Retail segment’s results was stronger compared to last year driven by better sales volumes and positive market trends. Consumer Services and Retail sales volumes increased by 3% compared to last year, with higher realization on core markets and seasonality effect, while non-fuel margin continued to grow. In line with mentioned positive trends, CCS EBITDA of the segment reached EUR 284 million, while Simplified Free Cash Flow amounted to EUR 142 million, an increase compared to 2024 when investment spending was higher due to turnaround investment activities in Rijeka Refinery.

Exploration and Production capital investments amounted to EUR 123 million, 26% higher than the previous year and were focused on Croatia. The onshore gas well Jamarice 183 was put in the production in July, gas production on offshore well Ika A offshore started in December, and the second exploration phase was approved for Sava-07 block. Compared to 2024, capital investments in Egypt slightly increased in 2025; on North Bahariya development drilling campaign is ongoing, with 13 wells drilled and 6 well workovers performed. EBITDA was lower following the lower Brent price and natural decline of production, reaching EUR 260 million in 2025. However, total daily hydrocarbon production was maintained above 21,000 boe which reflects the segment’s focused efforts.

Overall capital expenditure amounted to EUR 280 million. Rijeka Refinery Upgrade Project reached 99% of overall completion and is currently in the hot commissioning phase before the entire unit is put into trial operation, which is expected in March. The entire complex will reach full production capacity during 2026.

In 2025, net debt remained at the same level, at EUR 502 million with a gearing ratio of 24% following the continuation of strong investment cycle.

Zsuzsanna Ortutay, President of the INA Management Board, commented on the results:

“INA was successful and progressed across all business segments in 2025, demonstrating strong resilience and disciplined execution of our strategic priorities.

Retail performance remained strong, supported by robust demand driven by tourism and the continued development of our non-fuel offer. Investments in the Fresh Corner concept and loyalty programmes further strengthened customer engagement and profitability, confirming our successful transformation of the retail network into a modern convenience platform.

The Rijeka Refinery continued to operate at full capacity throughout the entire year, delivered record processing volumes, ensuring supply stability throughout the year. Record-high fuel sales on our core markets together with strong market shares reflect the strength of our integrated business model and logistics capabilities, supported by the refinery’s 21-month continuous operation at full capacity. Refining operations recorded an improved contribution despite ongoing sector pressures.

Our major investment project, the Rijeka Refinery Upgrade, is nearing completion, transforming the refinery into one of the most technologically advanced facilities in the region. Following the issuance of the required permits, the entire complex is expected to be fully operational in 2026, when we anticipate reaching full production, confirming Rijeka as the cornerstone of our refining business. In addition, progress on the hydrogen project supports our long-term decarbonisation ambitions.

In Exploration and Production, increased investments and focused portfolio management supported production optimisation and strengthened our resource base in both domestic and international operations in 2025, laying the foundation for improved sustainability of future production. I am proud of the achievements delivered by our teams, as this is the first time in the past 18 months that domestic gas production has recorded growth on quarterly level. I firmly believe that our teams’ dedication and professionalism have been pivotal in driving these results and advancing INA’s strategic agenda.

Overall, our results demonstrate INA’s ability to deliver stable performance while investing in long-term competitiveness, energy security and the energy transition.”

The full INA Group Unaudited Financial Report for 2025 is available here.

About INA Group

INA Group plays a leading role in oil operations in Croatia and a significant role in the region in oil and gas exploration and production, oil refining and distribution of oil and petroleum products. INA Group comprises several subsidiaries fully or partial owned by INA, d.d. The Group’s seat is in Zagreb, Croatia. Apart from Croatia, INA also has upstream operations in Egypt. Oil refining takes place at the Rijeka Refinery, while sustainable alternative businesses are being developed at the Sisak industrial site. INA’s regional retail network consists of more than 500 retail sites in Croatia and neighbouring countries. INA Group is a member of MOL Group.

PR

Avenija Većeslava Holjevca 10, Zagreb Phone: +385 1 6450 552 Fax: +385 1 6452 406 | @: pr@ina.hr