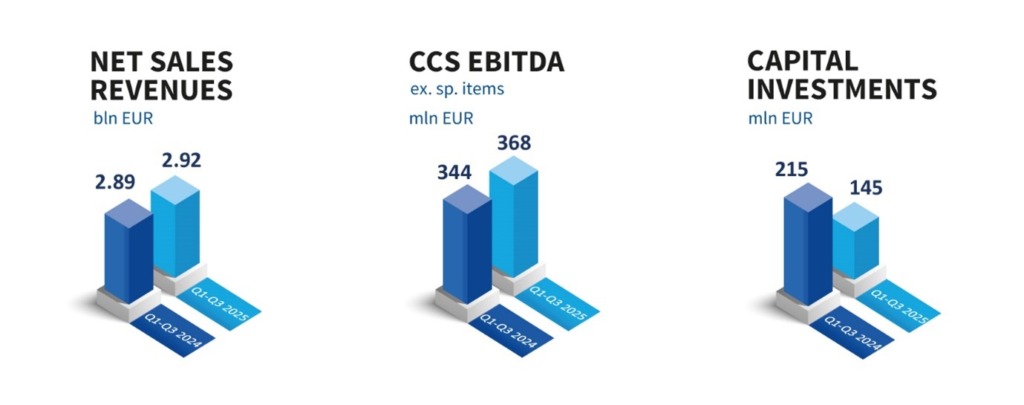

- Net sales revenues: EUR 2.92 billion

- CCS EBITDA: EUR 368 million

- Capital investments: EUR 145 million

- Modernization of the Rijeka Refinery: 98% of completion

- Growth of the retail non-fuel margin: 16%

Refining and Marketing incl. Consumer Services and Retail segment’s result was stronger driven by retail performance supported by positive market trends and tourist season. Consumer Services and Retail sales volumes increased by 3% compared to Q1-Q3 2024, with higher realization in the Croatian market (+28kt). Non-fuel margin continued to grow with a 16% increase. CCS EBITDA of the segment amounted to EUR 186 million, and Simplified Free Cash Flow EUR 114 million, an increase compared to the same period last year when investment spending was higher due to turnaround investment activities in Rijeka Refinery.

Exploration and Production EBITDA amounted to EUR 210 million, pressured by the natural decline of production and lower Brent price, partially offset by increased natural gas prices. Capital investments were focused to Croatia; 2nd exploration phase in Drava-03 is approved while trial production permit has been obtained on Jamarice 183 and the well was put in the production in July. On Ika A platform drilling has started in August. Compared to Q1-Q3 2024 capital investments in Egypt increased; on North Bahariya concession the development drilling campaign is ongoing, with 9 wells drilled and 6 well workovers performed.

Overall capital expenditure in Q1-Q3 2025 amounted to EUR 145 million, in line with lower investments in Refining and Marketing primarily attributed to the nearing completion of the Rijeka Refinery Upgrade Project, which has now reached 98%. Net debt was at the level of EUR 573 million with gearing ratio of 26%.

Zsuzsanna Ortutay, President of the INA Management Board, commented on the results:

“Despite the ongoing challenges of declining hydrocarbon prices and natural production decline, INA delivered stable results across all business segments in the first nine months of 2025.

Our retail performance remained strong, supported by a successful tourist season, growth in our non-fuel offer, and continued investments in network modernization and the Fresh Corner concept, which enhance customer experience and profitability.

In Refining and Marketing, product sales increased, and our logistics teams effectively supported heightened seasonal demand, ensuring supply stability. The Rijeka Refinery has been operating at full capacity throughout the year. The Rijeka Refinery Upgrade Project is now approaching its completion, a key step in the modernization of our refining system. In parallel, we have launched preparatory and exploratory works for a hydraulic barrier project under the refinery, an important investment in long-term environmental protection.

In Exploration and Production, we continued executing our production optimization program, while achieving successes in strengthening our domestic gas production portfolio. With the situation in Syria stabilizing, we also took the first steps toward the potential continuation of operations in the country with our delegation participating in an official visit to the Syrian Arab Republic.

Together, these achievements demonstrate resilience, operational excellence, and a clear strategic focus on sustainable growth and energy security.”

The full INA Group Unaudited Financial Report for Q1-Q3 2025 is available here.

About INA Group

INA Group plays a leading role in oil operations in Croatia and a significant role in the region in oil and gas exploration and production, oil refining and distribution of oil and petroleum products. INA Group comprises several subsidiaries fully or partial owned by INA, d.d. The Group’s seat is in Zagreb, Croatia. Apart from Croatia, INA also has upstream operations in Egypt. Oil refining takes place at the Rijeka Refinery, while sustainable alternative businesses are being developed at the Sisak industrial site. INA’s regional retail network consists of more than 500 retail sites in Croatia and neighbouring countries. INA Group is a member of MOL Group.

PR

Avenija Većeslava Holjevca 10, Zagreb

Phone: +385 1 6450 552 Fax: +385 1 6452 406 | @: pr@ina.hr