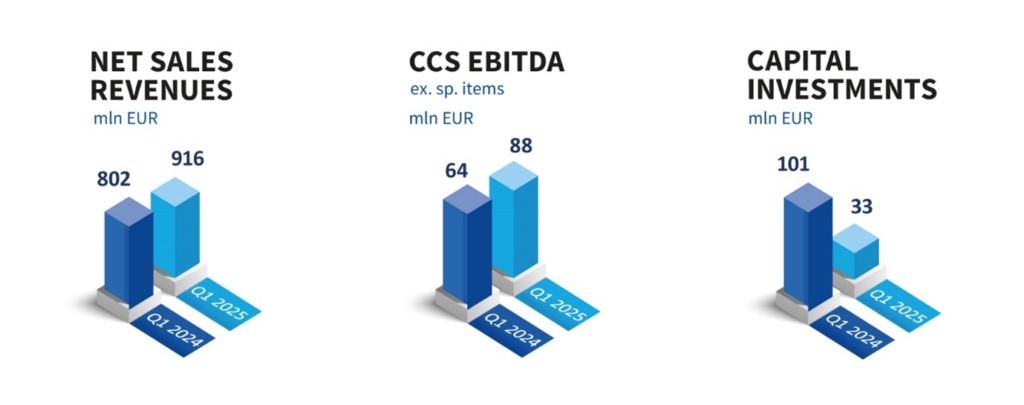

- Net sales revenues: EUR 916 million

- CCS EBITDA: EUR 88 million

- Capital investments: EUR 33 million

- Modernization of the Rijeka Refinery worth almost EUR 700 million: 94% of completion

- Growth of the non-fuel margin: 18%

Zagreb, 28 April 2025 – Following a stable 2024, the beginning of 2025 is marked by an improved gas price environment and a slightly lower crude oil price. INA Group performance in Q1 2025 was stronger compared to Q1 2024 mostly due to natural gas price increase as well as higher Consumer Services and Retail sales volumes and higher non-fuel margins. CCS EBITDA excl. special items amounted to EUR 88 million, which is a 38% increase compared to Q1 2024, with net profit increasing 197% compared to Q1 2024 and amounting to EUR 35 million.

Exploration and Production EBITDA was stronger following the higher gas price despite the natural decline of production – EUR 87 million. Capital investments were focused on Croatia with several important projects ongoing. Among others, notice of commercial discovery was submitted to the Croatian Hydrocarbon Agency for Obradovci-5 exploration well in Drava-03. Another important milestone in our step into exploring geothermal energy potential is the drilling on Leščan geothermal well that started on 25 March and is ongoing. In Central Gas Station Molve, the trial operations of power production from steam turbine successfully ended and after technical inspection INA received the Use permit. With a steam turbine, about 40 MWh of electricity is produced every day. Thus, the efficiency of the energy system on Molve has been increased for about 6%, for which amount the CO2 emissions will be reduced as well. Also, production optimization projects on Croatian onshore are continued, to decrease the natural production decline on mature fields.

Refining and Marketing incl. Consumer Services and Retail segment’s result was lower driven by pressure on refining and commercial margins from the external environment. Consumer Services and Retail sales volumes increased by 2% compared to Q1 2024, with higher realization in the Croatian market. Non-fuel margin continued to grow with 18% margin increase. CCS EBITDA of the segment amounted to EUR 13 million, while Simplified Free Cash Flow remains negative at EUR (4) million but significantly improved compared to the same period last year when investment spending was higher due to turnaround activities that took place in Rijeka Refinery.

Overall capital expenditure in Q1 2025 amounted to EUR 33 million. Rijeka Refinery Upgrade Project reached 94% of total completion. Net debt amounted EUR 596 million with gearing ratio of 27%.

Zsuzsanna Ortutay, the president of the INA Management Board, commented on the results:

“In Q1 2025, INA Group demonstrated progress across its various business segments, reflecting our steadfast commitment to operational excellence and strategic investments.

The Exploration and Production segment showcased stable performance, driven by higher natural gas prices. Capital investments were focused on Croatia to tackle the expected natural decline in production due to mature fields. Following several gas and oil discoveries last year, we continued with successful exploration results by submitting a commercial gas discovery on the Obradovci-5 exploration well in the Drava-03 block. The latest discoveries, as well as the previously discovered potential, could contribute to reversing the trends in hydrocarbon production. However, this also requires the acceleration of administrative processes. In addition, the start of our geothermal drilling represents a significant milestone in our renewable energy initiatives to diversify our energy portfolio with sustainable energy solutions.

The Refining and Marketing segment result, including Consumer Services and Retail, was pressured by external refining and commercial margins. Nonetheless, continuous operation in Q1 2025 at the Rijeka Refinery ensured safe and reliable supply during the winter period, securing a strong position and consistent market share within the captive market. Our efforts to enhance customer experience and retail offerings have driven growth in this area. Continuous investments in retail network modernization and further strengthening of the Fresh Corner concept resulted in both slightly higher sales volumes and an 18% increase in the non-fuel margin contribution. The tourist season is upon us, a period in which our retail chain and logistics must ensure three to four times more fuel than in the off-season. As in previous years, we are preparing thoroughly to be able to provide reliable supply.

Our strategic Rijeka Refinery Upgrade Project is in the final stage, and we expect mechanical completion in the last quarter of 2025. Despite the prevailing uncertainty in the global economy and the volatility of the energy market, INA Group remains robust, both operationally and financially, and well-prepared to navigate disturbances ahead.”

The full INA Group Unaudited Financial Report for Q1 2025 is available here.

About INA Group

INA Group plays a leading role in oil operations in Croatia and a significant role in the region in oil and gas exploration and production, oil refining and distribution of oil and petroleum products. INA Group comprises several subsidiaries fully or partial owned by INA, d.d. The Group’s seat is in Zagreb, Croatia. Apart from Croatia, INA also has upstream operations in Egypt. Oil refining takes place at the Rijeka Refinery, while sustainable alternative businesses are being developed at the Sisak industrial site. INA’s regional retail network consists of more than 500 retail sites in Croatia and neighbouring countries. INA Group is a member of MOL Group.

PR

Avenija Većeslava Holjevca 10, Zagreb

Phone: +385 1 6450 552 Fax: +385 1 6452 406 | @: pr@ina.hr